California is about to cut power company profits to historic lows. Your bill will barely drop

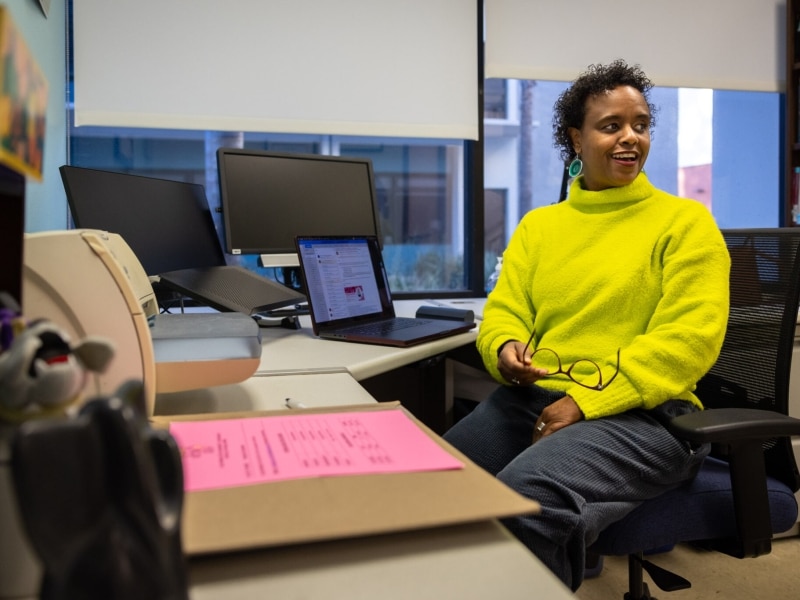

California utilities regulators are bringing down “return on equity” payments to power company shareholders. It’s the lowest profit margin in 20 years for PG&E and Southern California Edison, but will be hard to notice in your payments.

This story was originally published by CalMatters. You can sign up for their newsletter here.

With California electric rates stuck at nearly the highest in the nation, the state’s utility regulator is poised to lower the payout shareholders can receive from California’s three large investor-owned power companies.

In a proposed decision, the California Public Utilities Commission recommended dropping the “return on equity” by 0.35% each for Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric. If approved, shareholders of all three companies would see a potential return next year of just under 10%. Such returns for PG&E and Edison haven’t dipped below double digits in at least 20 years.

Utilities said the decline would affect their ability to bring in needed investment for their work. Critics of the decision said that the decline is too small to meaningfully impact ratepayers’ bills, even if it’s a step in the right direction.

“California and other [public utility commissions] authorize rates of return that are far in excess of the statutory requirement,” said Mark Ellis, former chief economist at Sempra, which owns San Diego Gas & Electric.

The California Public Utility Commission is expected to vote on the decision in December.

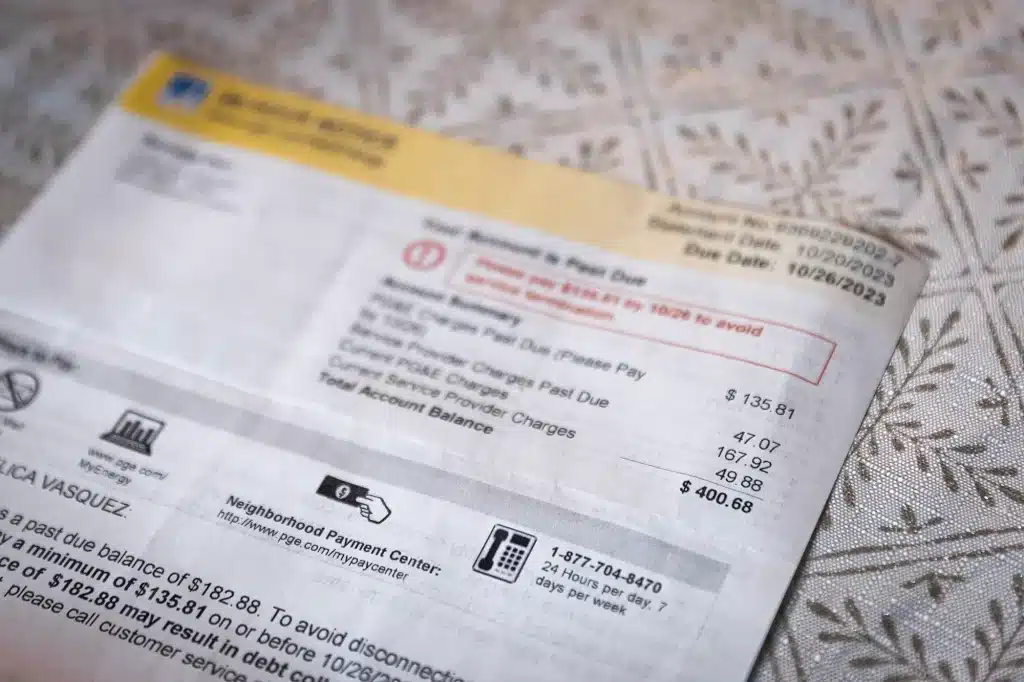

Californians pay the second-highest electric rates in the U.S. after Hawaii, according to the most recent figures from the U.S. Energy Information Administration. A number of factors go into those rates, including wildfire mitigation costs. PG&E in particular has attracted the ire of California customers for its frequent rate hikes within the last year.

Baked into those bills is the return on equity, money meant to compensate shareholders for the risk of doing business. These shareholder return rates are set by each state’s utility regulators and hover nationally around 10%. If approved, PG&E’s rate would be 9.93% (down from 10.28%), Edison would be 9.98% (down from 10.33%), and San Diego Gas & Electric would be 9.88% (down from 10.23%). These rates are not automatically guaranteed – utilities can fall short of this return if they don’t keep down costs, such as project overruns or unexpected lawsuit fees.

A small change in this rate can be a difference of millions of dollars for ratepayers. The return is a percentage of the rate base, the total value of a utility’s assets it can earn a return on; this includes projects such as building a new power plant, for example. The rate bases for California’s three large investor-owned utilities have steadily grown each year as they add new customers and projects, increasing the amount that shareholders can receive.

PG&E, for example, had a 10% shareholder return in 2023, a possible return of about $125 million. Had it been 1% lower, the potential return would have been $12.5 million less.

“The proposed cost of capital decision needs refinement to better reflect California’s unique risks and market realities,” said Edison spokesperson Jeff Monford. “Making those refinements in the final decision will enhance SCE’s ability to finance essential infrastructure projects for a more reliable, resilient and ready electric grid.”

PG&E spokesperson Jennifer Robison echoed this sentiment, saying the decision “fails to acknowledge current elevated risks to help attract the needed investment for California’s energy systems.”

Anthony Wagner, spokesperson at San Diego Gas & Electric, said, “A decision that accurately reflects these realities is essential to enabling investments that reduce wildfire risk, strengthen reliability, replace aging infrastructure and advance California’s clean energy transition for the benefit of the communities we serve.”

Utilities routinely request these rates be pushed higher because they are a key part of what goes into utilities’ credit rating, affecting the interest they pay on loans for infrastructure investments. But in recent years, experts and consumer advocates point to a mismatch – the utility industry is typically considered low-risk, but critics say the shareholder return rates don’t reflect that. Rates for U.S. 10-year treasury bonds, which are considered the benchmark for a risk-free investment, are about half of the national average for approved utility shareholder return rates. And it’s costing utility ratepayers across the country as much as $7 billion annually, according to academics.

Ellis, the former Sempra economist, said there is a way to lower shareholder returns while keeping customer bills in check and maintaining credit ratings that the commission has not yet explored – changing the balance of debt and equity each utility has.

“You really need to understand credit,” he said. “This is where they’re going to get you.”

The commission is allowed to set the debt-equity balance when it determines shareholder returns, but it left this unchanged for all three utilities in its proposed decision for 2026. Keeping shareholder return rates high as the main means for keeping credit ratings up, Ellis said, unnecessarily burdens ratepayers.

Do you have information or a correction to share? Email us: editor@shastascout.org.