“A Come-to-Jesus Moment”: Shasta County Board Says Jail Expansion Won’t Happen Without Voter-Approved Sales Tax

Contrary to what one supervisor has claimed, Shasta County lacks the funds to both build and operate an expanded jail facility.

On Tuesday, May 21, Shasta County Supervisors agreed that expanding the county jail won’t be possible, at least not without a new tax on voters. The board voted to take steps towards placing a sales tax on voters’ ballots in November.

“There needs to be a come-to-Jesus moment with the public that says we will not get a jail,” Supervisor Kevin Crye said during the meeting, “I don’t care what any politician tells you. We will not . . . There is no way it’s going to happen without a sales tax.”

Crye is among current politicians on the board who have for several years pushed the idea that the county would be able to launch a jail expansion project using Shasta County’s old courthouse, which was recently vacated.

About eighteen months ago, in December 2022, Supervisor Patrick Jones told Shasta Scout that the county would be able to expand the jail in the old courthouse space “because we’ve been saving many millions of dollars (and) we have the ability to move forward and finance the rest.”

“At the end of the day the facts are all there and are very clear,” Jones said at the time. “There’s certainly monies that can be moved around and new options.”

But information shared this week by Shasta County Deputy CEO Erin Bertain demonstrated that there is not enough county money to build or operate the expanded jail facility Jones dreamed of.

If begun today, the hoped-for jail expansion would cost $150 million. It will cost even more by the time such a project actually starts, Bertain said, which would not be for years due to environmental reports and other necessary steps, even once approved.

That money would fund an expansion that includes 192 additional jail beds, Bertain said. That’s a reduction from the 256-bed expansion the board has talked about before. And it’s still not clear how well that number would serve the county’s current needs. A formal assessment of how many additional jail beds are needed in Shasta County has not been conducted since 2018.

Bertain is taking the lead on providing the board with information related to the jail expansion project. That’s a role that had been assigned to former Shasta County Sheriff Eric Magrini, who was appointed to the newly-created position of Assistant Shasta County CEO in mid 2021 with two main tasks: managing a jail expansion and working towards illegal marijuana eradication. Magrini is still listed in that position but has not been at work since mid 2023, according to reporting from the Record Searchlight

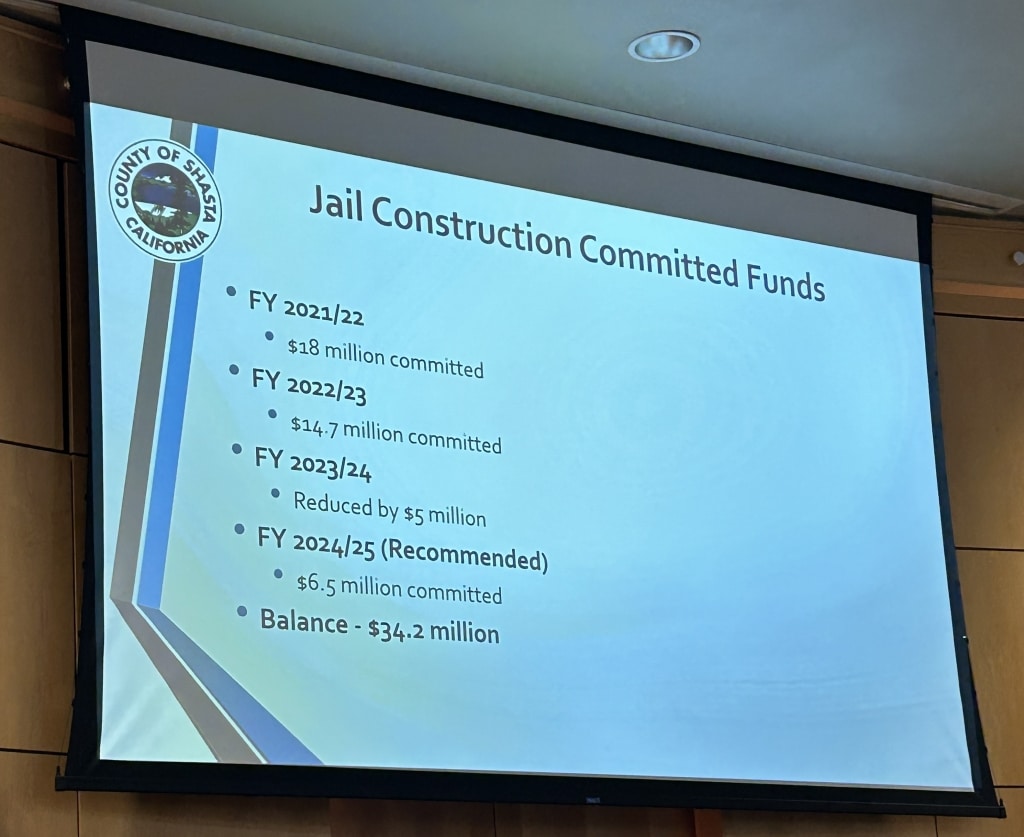

Over the last three years, the county has managed to save $34 million for an expanded jail. All of those funds were set aside between mid-2021 and mid-2023. During the current fiscal year, which began in July 2023, supervisors have reduced that pot by $5 million instead of adding to it.

To commit to building a jail, the county would need to find an additional $115 million. That money could come from bonds, Bertain said, but those bonds would require ongoing loan repayments. She estimated that the county would need about another $17 million annually to repay bonds for the jail, and pay operating costs.

Supervisors agreed that the only path to obtaining those funds is a countywide sales tax. Making a sales tax a reality would require an affirmative vote of the people via a ballot measure. But just how many people would need to support the sales tax depends on what kind of tax is implemented. A general sales tax, not committed to being spent on the jail, would require only a fifty-percent-plus-one vote to go into effect. A specific sales tax, which would include a commitment to spend the money only on jail costs, would need a two-thirds majority vote.

How large the sales tax should be was also a matter of debate. Bertain recommended a one-percent sales tax, which would bring in about $35 million, or twice as much as she is currently estimating for annual operation and bond repayment costs.

“I just don’t want to get us (to the place) where we can’t actually afford (the jail) by the time everything’s said and done,” Bertain said. “Now we have all this money set aside and we don’t have the money to actually pay the ongoing (expenses) because (the cost of) everything has gone up so much in the five-to-ten years it has taken to get the jail built.”

Supervisors ultimately voted to support the idea of putting a one-percent specific sales tax, dedicated to use for the jail, on voters’ ballots in November. The issue will come back to the board after staff lays out more details. It would have to be approved by the board before July 15, Bertain said, to make it onto voters’ ballots this fall.

Supervisor Mary Rickert pointed out that a previous effort for a Shasta County sales tax in 2020 did not pass, despite significant promotion. Like the board’s current approach, that initiative, known as Measure A, was also a one-percent specific sales tax with approved public safety uses that included jail construction and operations. Rickert and other supervisors at the time supported the tax, which failed, gaining only 51.5 percent of the vote.

“We had forums throughout the county, we went to every different small community and tried to talk to the public, to encourage people to support our sales tax initiative. And as you all know, it failed.”

“It’s an uphill battle,” Rickert said. “I just wanted to remind people of that.”

Do you have a correction to this story? You can submit it here. Do you have information to share? Email us: editor@shastascout.org