Here’s who’s backing Measure A, Redding’s citizen-led sales tax initiative

The Redding Rodeo Association and Advance Redding are the two largest donors among the dozens of organizations and individuals who have poured just over a quarter of a million dollars into the sales tax initiative. Measure A will appear on ballots this fall.

As of Oct. 5, about 40 organizations and individuals have provided monetary donations in support of Redding’s Measure A. Those donations total about $267,000

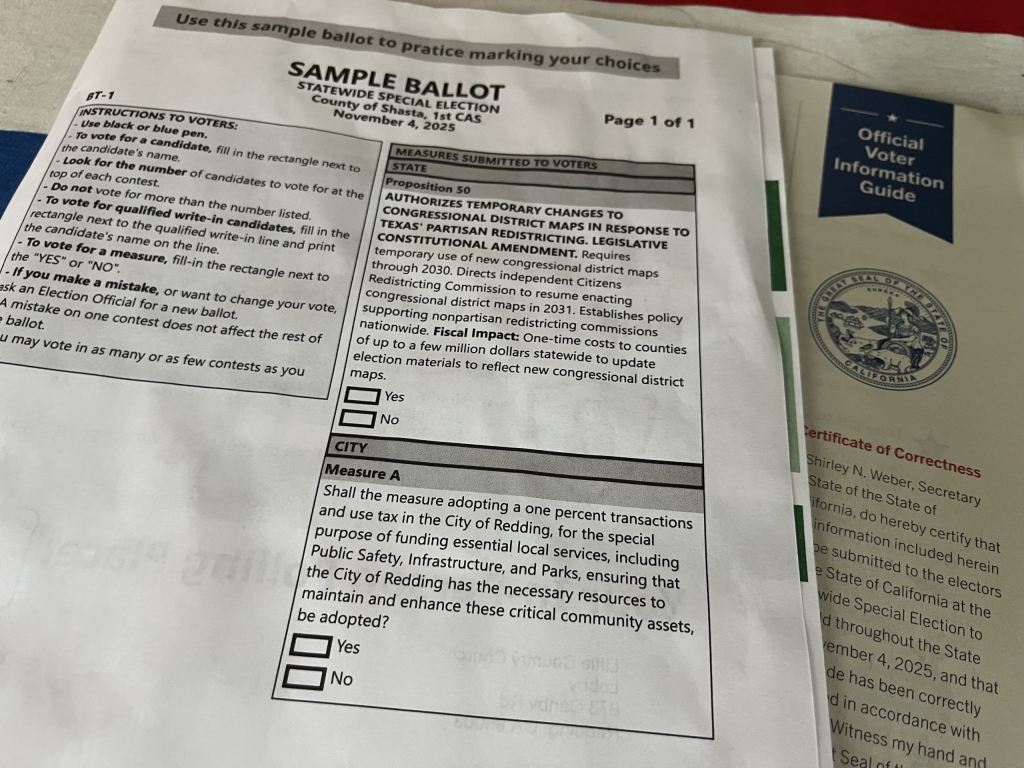

Measure A is a citizen-led tax initiative that will appear on voter ballots this November. Redding residents will be asked to approve or strike down the additional 1% sales tax that would be used to fund police and fire, incarceration facilities, parks, roads and public infrastructure at the Redding Riverfront.

If passed, the ballot initiative would double the amount of sales tax Redding retains for community use, providing approximately $30 million to the city annually. That money could help build new fire stations, restore the Redding Soccer Park and much more.

Among the biggest financial backers of the measure is Advance Redding, the nonprofit that operates the Civic Auditorium. The organization gave just under $50,000 to the ballot measure, which would distribute 6% of tax benefits, or about $1.8 million annually to benefit the Civic if passed. Funds could help shore up the aging facility which needs new HVAC, among other major fixes, former city manager Barry Tippin told Shasta Scout last month. The money could also go toward subsidizing the operations of the Civic, helping keep the facility open as finances at the nonprofit that manages the Civic have tanked over the last year.

The Redding Rodeo Association, another northern riverfront stakeholder, is also a large financial backer of the measure. Financial filings show the organization, which was recently granted a long-term lease of land at the northern riverfront, has donated $40,000. If passed, 3% of the additional sales tax revenue, or about $1 million, would be dedicated to construction, improvement and maintenance related to the Rodeo grounds.

Other large donors in support of Measure A include the Redding Rancheria ($20,000), Sierra Pacific Industries ($25,000) and Bryant Wellness Partners ($20,000) — an Alameda–based cannabis and alternative health business. Turtle Bay Holdings, Inc. gave $5,000 and Simpson University gave $2,500.

Some professional associations are also supporting the sales tax measure. The California Association of Realtors Issues Mobilization PAC donated $10,000 and the Redding Independent Employees Association gave $5,000.

On the public safety side of things, police and fire associations are also in support including the Peace Officers Association of Redding ($5,000) and the Redding Police Manager’s Association ($1,500) as well as the Redding Firefighters Political Action Committee ($5,000).

Some businesses in the construction industry have also been big donors. They include S.T. Rhoades Construction ($15,000), J.F. Shea Construction Inc. ($15,000), Independent Structures, Inc. ($10,000) Other business donors of $1,000 or more include Cox & Cox Construction, Inc. ($2,500), Dars Cox Construction Inc. ($2,500) Langum Land & Cattle ($5,000), Ardent Security ($4,900), Frozen Gourmet, Inc. ($2,500), K & S Staffing Solutions, Inc.($2,000), Mikala Corp. ($2,500), and Wards Concrete ($1,000). Brian Kamisky of SK Construction also donated $1,000.

Other individual donors who donated $1,000 or more include former Anderson council member Baron Browning ($4,900), , Steven Williams ($2,000) Cristina Prosperi ($1,000), Lee Salter ($1,000) and Susan Leaverton ($1,000.)

Who else is behind Measure A?

In August a spokesperson for Citizens for a Better Redding, the group behind the measure, said organizers are made up of “a diverse coalition of individuals” including Dennis Morgan, Zach Bay, Jennifer Johnston, Dave Silva, Baron Browning, Michelle Nystrom, Julie Dyar, Christina Prosperi, Kenny Breedlove and Lane Rickard. Of those 10 individuals, one is a Redding Chamber staff member and four others are Redding Chamber board members.

Who’s opposing Measure A?

Signs opposing Measure A have cropped up around Redding in recent weeks, although city filings show that no significant funds have been raised in opposition to the measure. Jay Dunlap, a Redding resident and co-owner of the engineering firm Sof-Tek — who spoke to Shasta Scout about his opposition to the measure this week — said grassroots opposition has only begun organizing in the last six weeks.

Organizers against the measure, Dunlap explained, include himself, former county board candidate Dale Ball and Joe Kneer. He said the three have used their own funds as well as small donations from others to pay for the signs around town. Donations they’ve received have totalled about $1,500 so far, he said.

What’s next?

The sales tax initiative will appear on Redding voters ballots on November 4. If more than 50% of voters support the measure, it will pass. The language of the initiative requires the city to appoint an advisory board to monitor use of the funds which will be placed in a special account. The city will also be required to conduct an annual independent audit of fund use. However the measure does not contain wording to prevent supplantation. In other words there’s no mechanism in place to prevent the city from using the funds from the sales tax to replace current city funding dedicated to costs like police and fire.

10.9.25 4:01 pm: We have updated the story to correct a name.

Do you have a correction to share? Email us: editor@shastascout.org.

Comments (14)

Comments are closed.

This is outrageous. Why are residents being bled dry. ALL of the things they promise to fix with new taxes are things that should already be covered by the confiscatory taxes we already pay. If your city leadership doesn’t budget wisely now then why would you trust them with more. Roads? Terrible and we already pay big. Jail? Already funded? Fire and Police? Already well paid with retirement plans that are bankrupting the state. Do we need a new firehouse to endlessly respond to vagrants? But hey, it is always fun to spend other people’s money for your pet projects. This is the most corrupt small town in the country.

I will be voting NO on measure A as it is currently worded. I want to see CLEARLY earmarked dispersions that cannot be abridged, countered, withdrawn, supplanted, redirected or otherwise exploited. No ambiguities, no double talk no closed door deals. Without absolute transparency for the distribution of the funds raised by this measure, the vote should be NO.

I have no dog in this fight for Measure A. I live outside of the Redding city limits. But I do shop in Redding. If I wanted to save a few pennies or dollars I can shop outside of the Redding city limits. Looking at this at over 30,000 ft. I recommend the increase of sales tax from 7.25 percent to 8.25 percent.

If you shop and enjoy city-provided services in Redding, you have a dog in the fight.

Those who stand to profit from increasing prices for citizens are not my concern. A NO from me.

The city has been putting 1% sales tax measures on the ballot every few years for at least 30 years now. And every time, they push it as “needed for Police, Fire, and Jail'”. And every time, the voters say “nope”.

Maybe some year they’ll ask for money for something people want to pay for instead.

So witty.

Please post under the name that most people know you as on here.

Welcome to the age where you are not quite as incognito on the internet as you think you are.

Ok Jay, Gary or whatever.

You were wrong, you are still wrong, and you always be wrong.

You like to spread misinformation any way you can.

The truth will be there no matter what you do.

Exactly what In The Know said…”In other words there’s no mechanism in place to prevent the city from using the funds from the sales tax to replace current city funding dedicated to costs like police and fire.”

The City will screw the citizens if this measure passes. Barry Tippen couldn’t retire fast enough. He walked away and washed his hands of the mess he left the City in. Tippen knows why there are no funds to fix roads, etc., he needs to be held accountable.

You get what you pay for…..I only wish there was another way to get revenue to augment all of the items the measure proposes to do/ fund.

Increases in sales tax are a slippery slope and in the end, the monies usually pay salaries and unfunded liabilities that the city and county encounter. And, it hurts businesses on big ticket items.

The state , along with cities and counties are literally taxing us out of our homes and the flight from California will continu

Thanks, Shasta Scout, for the article. Taxes are a fundamental part of the American socioeconomic and political system, dating back to the dawn of civilization. I understand how this topic can evoke strong feelings. The far left advocates for extreme taxation of the wealthy, who have benefited from American culture, while the far right pushes for extreme tax cuts, which have contributed to significant inequality. Recent data shows that the top 10% of U.S. households control around 65% of total wealth, with the top 1% holding 30.8%. (The top 10% also control the political system that sustains tax inequality, favoring the wealthy, and efforts like Trump’s aim to weaken the IRS exacerbate this.) The rest of us, in the 50% bracket, own only about 2.5% of all wealth. Redding is mainly middle-class, and America’s middle class holds roughly 25% of the nation’s wealth. This CHART (https://www.statista.com/statistics/203961/wealth-distribution-for-the-us/#:~:text=U.S.%20wealth%20distribution%20Q1%202025%20In%20the,owned%202.5%20percent%20of%20the%20total%20wealth) clearly illustrates the divide between those with wealth and those without. Measure A combines a flat progressive tax with a consumption tax—the more you spend, the more you pay. All the vital links that hold our society together—such as laws (courts, DA offices, law enforcement), education (public schools and colleges), infrastructure (roads, fire departments), health systems (hospitals, Medicaid, Medicare), and even food for working families—are under attack by the extreme far right (Trump). Measure A aims to strengthen law enforcement and Redding’s infrastructure. Without reinforcing these bonds, society risks unraveling to the point where only private companies respond during emergencies, demanding full payment or insurance details before they roll out a hose and turn on the water. And, sure, that might be acceptable if you’re in the top 10% of America’s wealth system. After all, you could buy your own fire or police service, and they would own the first responders for everyone else.

I don’t think taxing the rich is “far left” considering when FDR turned the nation around with The Big Deal that taxed them, at the very least, 78%. Now the rate for them, gets smaller and smaller, and since Reagan, they also get tax loopholes, and ways for evasion regarding passing it after death, and others

I’m voting for measure A with the concerns outlined previously.

1. That The Citizens Oversight Committee be made up of individuals not related to, or business partners of, councilmembers.

2. The bad faith request Julie Dyar and Advance Redding gave to Redding City Council by withholding important information. The city council gave them 675k– which I was dead against from the beginning– without having the knowledge that AR made a 50k donation under cover of darkness to Measure A. I think AR has to go if/when we can find a professionally managed and more transparent company to run things and truly advance Redding!

Meanwhile, I want our roads repaired, and public safety– fire and LE, to have what they need. It’s not perfect but I see nobody coming up with any other alternatives.

Everybody should pay close attention to the last two sentences:

“However the measure does not contain wording to prevent supplantation. In other words there’s no mechanism in place to prevent the city from using the funds from the sales tax to replace current city funding dedicated to costs like police and fire.”

This is what the City is counting on.