Shasta County Will Hold A Public Hearing On Suspending Impact Fees. Here’s What You Need To Know.

We answer your questions about impact fees, including what they fund and how the suspension of impact fees could affect the county.

1.28.23 12 pm: This article has been updated to correct a statement that it’s cheaper to build than to buy locally. In fact, the linked information shows the opposite is true, it’s cheaper to buy than to build in Shasta County. Thanks to readers who helped us correct this information.

1.22.24 10 pm: The article has been updated to clarify why some areas of the unincorporated county have higher impact fees than others.

On Tuesday, January 23, the Shasta County Board of Supervisors will hold a public hearing about impact fees. They hope to pass an ordinance that would indefinitely suspend the collection of developmental impact fees within the unincorporated parts of the county.

Statements made during the board’s January 9 meeting indicate that supervisors Kevin Crye, Patrick Jones and Chris Kelstrom support suspending impact fees because they believe that doing so will stimulate economic growth across Shasta County.

Supervisors Tim Garman and Mary Rickert support the idea of reducing but not suspending impact fees, to ensure continuity of a funding source. They’ve asked for more comprehensive information on the subject before a new ordinance is passed.

The decision to suspend impact fees could become final tomorrow, January 23, after a public hearing on the topic. Here’s what you need to know.

What are impact fees?

Development impact fees are one-time charges levied on builders during new development. They’re intended to ensure the developer pays for the increased costs of new development on services that the entire community shares.

Impact fee revenue is not stable, predictable revenue because the amount of new development ebbs and flows over time in response to factors like interest rates, construction costs and material availability.

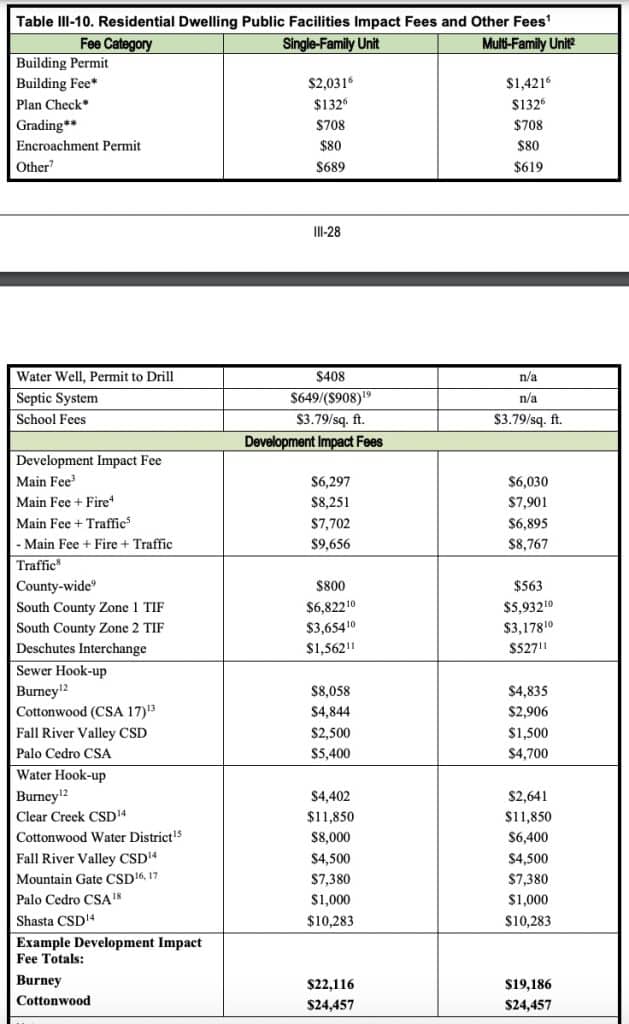

Development impact fees are also only one part of the fee structure that builders are required to pay. Additional fees can include building permit fees, school fees, septic fees and more.

This chart from Shasta County’s General Plan Housing Element for 2020-2028 shows the many kinds of fees, including development impact fees, that are levied on those who build in Shasta County.

How were impact fees set in Shasta County?

In California, impact fees are set county-by-county. California law indicates that impact fees should be reasonably based on the actual costs associated with the impact of new development.

In Shasta County, impact fees were implemented in 2008 in response to a study commissioned by the county. Shasta County’s impact fees are charged in connection with a number of services including public protection, public health, and libraries. They’re also charged to fund governmental facilities including those for Sheriff patrol and investigation, animal control, fire protection, traffic, and parks. Some impact fees also go to administrative uses.

Who pays impact fees?

Impact fees are paid by anyone building a single family or multi-family residence, as well as those building office, commercial or industrial buildings and mini-storage facilities.

What is the average cost of impact fees for those building a new single family residence in Shasta County?

The average residential new home in Shasta County costs close to $500,000 to build. According to the county’s General Plan Housing Element, about $45,000 of that cost comes from local and regional fees, including impact fees.

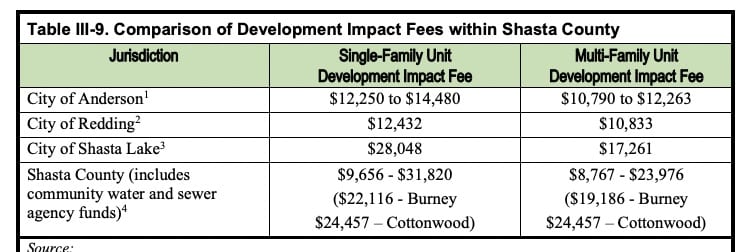

The cost of development impact fees varies by location. Within the City of Redding, for example, fees are $12,400 on average for a single family unit. In contrast, in the unincorporated area of Cottonwood, fees are almost double that, about $24,500.

That disparity, Shasta County’s Director of Resource Management, Paul Hellman clarified for Shasta Scout, is that some parts of the unincorporated county have additional development impact fees such as traffic fees, which are added on top of the county’s typical residential impact fees of $6,000 – $10,000 for single family homes.

A chart from Shasta County’s General Plan Housing Element for 2020-2028 shows how impact fees vary from city to city and within the unincorporated parts of the county.

According to one data analysis, in Shasta County it’s cheaper to buy, than to build a new home, when fees are considered.

Does the cost of impact fees contribute to housing shortages?

According to the county’s housing plan, which was last updated in 2020, the combination of new development fees from the county and others “collectively pose a constraint to the development of affordable housing.”

The county will review development impact fees on an annual basis, that report says, with special attention to reducing the fees associated with building affordable housing.

How much revenue is generated by Shasta County’s impact fees?

Between 2008 and 2024, Shasta County’s impact fees generated $8.7 million in local revenue, which averages out to about half a million dollars a year.

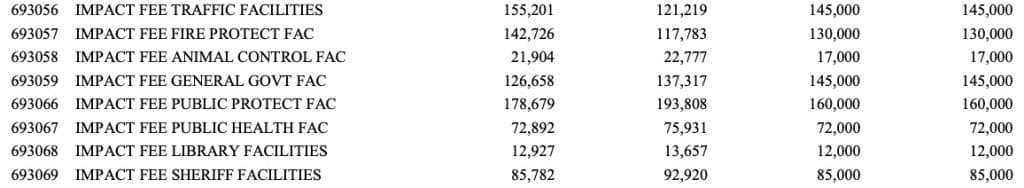

In June, Shasta County supervisors approved a budget that included anticipated revenue of $766,000 in impact fees. That means if Shasta County’s impact fees are suspended this month the county’s revenue is likely to be reduced by about $400,000 during the remainder of this fiscal year, and double that amount annually moving forward.

Supervisors Jones and Crye say that revenue will be more than made up for in tax revenue from increased development stimulated by suspending the fees.

A screenshot from the Shasta County budget FY 2023/2024. Left to right the columns indicate 21/22 actuals, 22/23 actuals, 23/24 recommended and 23/24 adopted.

What are impact fees used to fund?

California counties are allowed to use impact fees in a variety of ways as long as they provide services to the new development that paid the fee. In Shasta County, impact fees have been used to fund a juvenile rehabilitation facility, a fire station, a sheriff’s patrol station and an emergency operations center.

Impact fees are not used for recurring costs like salary in part because they do not provide stable, predictable revenue year-over-year.

How much of Shasta County’s impact fees have been spent?

So far, $3.2 million of Shasta County’s $8.7 million in impact fee revenue has been spent.

Shasta County already has plans for how to spend remaining impact fees which are slated to support a number of projects moving forward. Those projects include an expansion of the county jail, a mobile clinic for public health, emergency evacuation equipment for the county’s animal control, and a significant bike/pedestrian transportation project at Knighton Road.

The remaining $5.5 million in impact fee funds will not fully cover the costs of these projects, which are estimated to cost about $118 million in total and were supposed to be funded from a combination of impact fees, the general fund, grant funds and debt financing.

What will happen to these projects once Shasta County’s impact fees are suspended?

Supervisors have not discussed if or how they intend to pay for any of the projects which would have benefitted from impact fees moving forward. Since there are still significant impact fees in reserve, the impact of suspending impact fees will likely not be felt for some time, perhaps after current supervisors are no longer in charge of the county budget.

Do you have a correction to this story? You can submit it here. Do you have information to share? Email us: editor@shastascout.org

Comments (22)

Comments are closed.

After seeing the devastation in Shasta County over the years from fires like the Zogg, Bear, and the freakishly awesome and terrifying firenado caused by the Carr Fire, I think that a waiving of fees would be best if applied to replacement construction… Not new construction. This could encourage people to rebuild rather than leave.

Whatever is decided by the BS, the Shasta County Resource Management office needs to honor any incentives.

Anyone building should do their research regarding the infrastructure and costs of the utilities before deciding. Clear Creek CSD implemented new service rates and raised rates by over 200 – 500% without using a drop of water. Over $11,000 impact fee to get CCCSD restricted water? Well permit $408 and not having to pay the service fee or the high unit price.. no brainer.

PG&E has a double digit rate increase effective this month with 2 more rate increase requests on file with the CPUC.

No place is perfect, but I have watched Shasta County slide so far away from that over the past 2 decades.

Thank you for the rundown on this complex issue.

One possible correction: If you take a closer look at that website, the average home in Shasta County sells for less than it costs to build new. It’s the spendy coastal areas where the reverse is true.

Thanks so much for this correction. I took another look and you’re right, while I used the information from a graph header which reads the opposite, the actual data included shows buying is cheaper than building. I have updated the article and added a correction notice. I’m grateful for your help. 🙂

Great article, thanks.

Did many actually read this article? I wonder based on the comments.

It points out that costs and comparing to the city’s I think lowering or eliminating for a set time could be in order. Add the slow down in housing and it couldn’t come at a better time. Eliminating completely may not be the best but maybe on par with or certainly less than the city fees. There was a time in the past where the county fees were significantly less than the city. Now looking at home owners insurance and power costs they need to attract builders in the county.

As far as Jones and fees you are talking peanuts based on what’s planned and comments seem more political based.

It’s not about the amount that’s concerning it’s the principle of the matter.

$1 or $20,000 he should have recused himself as it has a DIRECT impact on him and his personal finances and potential business operation.

Politically based? You bet it is – he’s a politician in a political arena and the issue is centered around his vote…so yeah, it’s political.

Curious, what amount would make it a concern to you?

Wow! After reviewing some of the other comments on this post, it becomes quite a parent that many people believe in taxation punishment!! they have no problem voicing their opinions using other peoples money, mindblower as usual!! But totally understood when you realize they are extremely left. Leaning people! They are used to living off of other peoples money. Sad really

They are not left people, they are people with a lot of common sense, which is how we are going to get out of this mess. Some right persons don’t always have common sense so it seems.

Enough of the maga boy’s and their games. It’s all about themselves and what it will do for them. Not the people of Shasta county.

Knowing all that’s been said above…email and call the BoS right now…just say…NO ! Do Not Remove the Impact Fees !

pjones@co.shasta.ca.us

ckelstrom@co.shasta.ca.us

kcrye@co.shasta.ca.us

Mary Rickert & Tim Garman already voted No, so we can count on them.

Again, we see a rush to Action with NO PLAN just like Dominion and other brainless decisions made by the Jones Gang over the past year. This does not benefit “the little guy.” This benefits the Fat Cat developers and not Joe 6 pack on the bottom. Who even wants this? Who’s pushing for it as Mary asked? She was blown off. Why can’t we wait until we hear from real SME’s and not the Jones Gang? How the hell are we going to pay for the projects enumerated in the article?…………… Waiting……. Jones Fort?

I hope intelligent, articulate people can show up and go on record as to why this is a big mistake.

I would think the impact fees would not be due until a building permit is issued. I don’t believe Jones has a permit to build anything yet.

That’s why he’s waiting to pull his permit. To save himself $20.000

I did not see solar panel installation permits in the list, or the revenue from penalties. Any stats on that?

Is anyone from the public or the press asking about what appears to be a direct benefit of dismissing these impact fees at the same time a project is being developed by Supervisor Jones for a new gun range? Doesn’t that seem like a direct conflict of interest and therefore, shouldn’t he recuse himself from any vote on impact fees?!

Stephen absolutely, and you know they will vote and pass this after the open comments.

It sounds like a direct conflict of interest because it is! A Patrick Jones swing vote to end the development impact fees would bring him a windfall of approximately $20,000 when he pulls the building permits for his project. Ultimately, the bill for his personal gain would fall to the taxpayers of Shasta County.

While terminating the impact fees is clearly bad fiscal policy, Jones choosing to ignore his obvious conflict of interest would be worthy of prosecution and could ultimately invalidate a Board of Supervisors decision.

I agree completely. If they put this through Jones should be held accountable for illegal actions to save himself money.

County public works director Paul Helman

stated at at the last BS meeting that impact fees for a house in the county ranged from $6000 to $9000

Yes that’s an interesting contrast to the numbers from the Shasta County Housing Plan element. I’ll reach out to Hellman and see if I can get comment.

I have updated the article to include information shared by County Resources Management Director Paul Hellman. He said that while the $6-10k number is an accurate amount of base impact fees, some areas of the county also charge additional impact fees as shown in the chart in this article which, he confirmed, is also accurate.

Fees is another cute word for tax! Anytime you eliminate a fee you are eliminating a tax and any conservative will applaud this ! Having said that, living within a budget is the key! And by the way, the increase in volume always generated more revenue! It has been proven time, and time again! Not to mention, nobody has ever text themselves into prosperity ever

Taxed themselves into prosperity